The storyline of the past several years in the professional carwashing market has only intensified this past year. Despite economic and global uncertainty, investors marched through 2020 and into 2021 expanding, building and acquiring. Changes have occurred throughout operator, supplier and manufacturer ranks — all using different strategies with the same mindset: Grow and do so rapidly. While the industry still features many of the same familiar brand names — with more emerging seemingly monthly — these companies have changed in numerous ways.

No time to read this article? Listen to it instead!

As many operators stand on the sidelines, watching the merger and acquisition (M&A) headlines, what is their future in the market, and how are they being impacted today? Additionally, what does widespread growth mean for our market’s future?

Moreover, are the same best practices that operators have employed for decades still effective today? For instance, is an A-plus site with modern equipment still the secret to success in beating the competition?

Operators undoubtedly have many questions these days. We reached out to a few market insiders for some insight and answers to these inquiries and more.

Exploring expansion

Carwash chains that weren’t even established five years ago are outpacing the growth of many long-established, family-owned and -operated businesses. Private equity and large investors are teaming up with market leaders to create brands, then build and open fast. In the past, investors would come into the market and be satisfied with opening one or maybe just a few locations. Today, these investor-backed companies are looking to build new wash locations by double digits each year.

Jeff Pavone, founding partner of Amplify Car Wash Advisors and Commercial Plus, confirms, “The current state of the industry can be summed up as ‘get big fast.’ Whether it’s from mergers and acquisitions or development, now there are many brands looking to grow and grow fast, and it’s not just Driven Brands Car Wash North America and Mister Car Wash.”

What used to be a fairly conservative growth curve is now a hyper-growth curve with a race to scale in as many markets as possible, adds Pavone. “Private equity-backed groups have seen incredible success testing the carwash waters, and now they want more. The carwash industry is changing from what used to be small regional chains to big-money-backed developers wanting to build nationwide, not just in their own market. And, this trend is showing no signs of slowing down,” he surmises.

Many once-regionally-focused-only carwash brands are starting to explore opportunities in other states. As noted by carwash equipment manufacturers and others, one wash format is significantly outpacing the rest: express exterior. With low labor and high compatibility with unlimited plans, which helps secure stable income for investors, express exterior new builds are spreading throughout most parts of the U.S. with no slowdown in sight.

Bill Martin, who is the owner/CEO of Metro Express Car Wash and partner of Amplify Car Wash Advisors, recalls a time in our industry’s not-too-distant past when new locations were built in the U.S. at only a double-digit clip; that pace has greatly escalated today.

In Boise, Idaho, where Martin operates, there were about six carwashes in the area a few years ago; that number has ballooned to nearly 30 locations — with more surely in the works. He calls what’s developing in his area a snapshot of what’s occurring on a national scale.

“We have some good data that shows, in the 12 months from March 2019 to March 2020, there were 1,000 conveyor carwashes constructed and open in the U.S.,” explains Martin, who adds that competition is closing in on many operators and that respecting the boundaries of an established carwash’s service radius is a tradition that is waning. “This all combines to put a lot of pressure on operators who are currently in the business as they think about their next steps.”

These next steps include selling or staying put. If selling is of interest, the timing for that decision is ideal today. Many market insiders, including Pavone and Martin, report that leading operators are getting top dollar for their washes these days.

Who’s your data?

If staying put is of interest, operators choosing this path cannot rest on their laurels. Due to a now-elevated cost of entry, the investors building in your area are likely more sophisticated than ever before.

“If sites don’t focus on customer relationships and experience, any competitor willing to be a dollar cheaper will happily take what they have. Therefore, more sophisticated tactics are needed to claim the market share,” recognizes Chris Moriarity, senior vice president of strategy for Suds Creative™.

Such tactics as capturing customers’ data are still in their infancy, but those involved in developing the technologies and programs are seeing encouraging potential.

“These industry trends are all driving a quest for data. The more data you can access, the more likely you are to develop strategies that truly drive loyalty and relationships with your members, and the more likely you are to thrive in this market,” adds Moriarity.

Fortunately, industry manufacturers and technology providers are making it easier and easier to capture this data today. As seen on the operator side, many equipment and chemical manufacturers have joined forces in recent years, combining decades of experience and technical know-how. Large investors are also fueling growth and product development in this segment of the market as well. The result is that technology is evolving in this industry at an accelerated pace.

“This has and will continue to work to our advantage both in terms of attracting more customers to our businesses and being able to service them and retain them more effectively,” says Martin.

Once your business has captured customers’ information, finding out what to do with it is the next obvious step. Text message, social media and app-based marketing are evolving technology strategies and platforms to consider. Software can also be used to help organize and visualize data.

“A good point-of-sale system should provide a wealth of data, but often operators struggle with how to interpret that data to inform their strategies. To truly leverage this information, they will need to utilize advanced technology and tap industry experts,” concurs Moriarity.

Market challenges

Whether your business has one location or hundreds, all operators face similar challenges when operating a carwash. Those we interviewed for this article cite labor and competition as prevalent market issues affecting all operators today. The pandemic has bruised, beaten and deflated many American workers. Layoffs and furloughs occurred at record numbers last year as employees in major industries, such as air transportation, hospitality and food service, bore the brunt. Even though the carwash industry as a whole fared better than others, a number of operators also made tough decisions on employees.

Many Americans have taken the past year to reassess their futures, and businesses are now feeling the crunch as the labor market tightens. Some of the unemployed have more incentive to stay out of the job market these days as well.

“Like many employers, carwash operators are struggling to find good hourly workers. One potential reason is that the multiple stimulus checks and ongoing supplemental unemployment benefits are making people less eager to return to work,” asserts Moriarity, who adds that some workers still feel unsafe going back to work while COVID-19 remains an issue or that they can’t work outside of the home because their children are unable to return to school or daycare.

“Carwashes are also competing for talent, not only with other retailers but also with other businesses that offer perks they can’t, such as remote work. A side effect of this is higher labor costs, because operators are forced to pay more to get workers,” continues Moriarity.

Some operators — from big cities to small towns — are reporting to Professional Carwashing & Detailing that their starting wages have escalated to a minimum of $17/hour to attract workers. Labor has always been a critical issue for our industry’s operators, but these developments have exacerbated the issue. While operators, including Martin, call this period “almost impossible to manage through,” they are hoping that it is only a short-term hurdle.

One other evolving issue that Martin has been monitoring is regulations.

Regulations, mount up

Operating a carwash involves a maze of zoning and permitting through which all investors must navigate. Municipalities across the country regulate and restrict critical resource usage, including water and gas, adding pressure to operate such businesses as carwashes. As the industry’s number of carwash locations continues to grow, our market’s dot on these municipalities’ radars becomes more noticeable.

“So, if we’re growing at 1,000 new conveyor carwashes each year, it will garner more attention from municipalities and states, putting pressure on operators to operate more cleanly as fees increase,” states Martin.

As costs to operate, build and stay ahead of fees and fines mount, prices are not keeping pace, the experts say. In fact, with unlimited plans, operators are washing more cars these days at lower revenue per customer averages. The intense focus to build is also causing many chains to build on less-than-A-rated sites, and this is yet another trend Martin continues to monitor.

“Some operators are building on B or C [-rated] sites, and my prediction is that some will unfortunately not perform as expected and fail. Word spreads fast in this industry, and when enough vendors see that happening, they’ll pull back and slow down. I’ve seen it before,” notes Martin. “Carwashing has never been about just buying the latest and greatest in equipment, which is important. It’s always been about finding a great site, training and proper operations.”

Competitive edge

Moving forward into this new era of professional carwash sophistication, what changes do operators need to make in order to stay competitive? If a refresh of the carwash is needed, that is a good place to start. This can be as simple as a fresh coat of paint or as extensive as a complete renovation. If your carwash looks old and outdated, it will be perceived as such by customers. Modern carwashes are attractive and inviting, and they resemble centers of innovation.

Once your carwash appears modern and high-end, another area of focus should be pricing.

“Underdeveloped brand positioning and the lack of price optimization are trends that are costing the industry millions of dollars a year, and it’s hampering the ability of washes to capture market share,” explains Moriarity. “Brand positioning establishes your identity, which influences what you can charge. You can’t sell a Ford with Ferrari pricing.”

As Moriarity adds, if every carwash site in a town looked exactly the same and charged the same prices, why should anyone come to you? What does it mean to be a member at your site versus another? “Finding these answers can pave the way to market share and insulate the site from increased competition,” he notes.

The traditional pricing strategies that operators have used for decades may not be effective moving forward. Simply looking at the competitor’s prices to establish your menu isn’t enough.

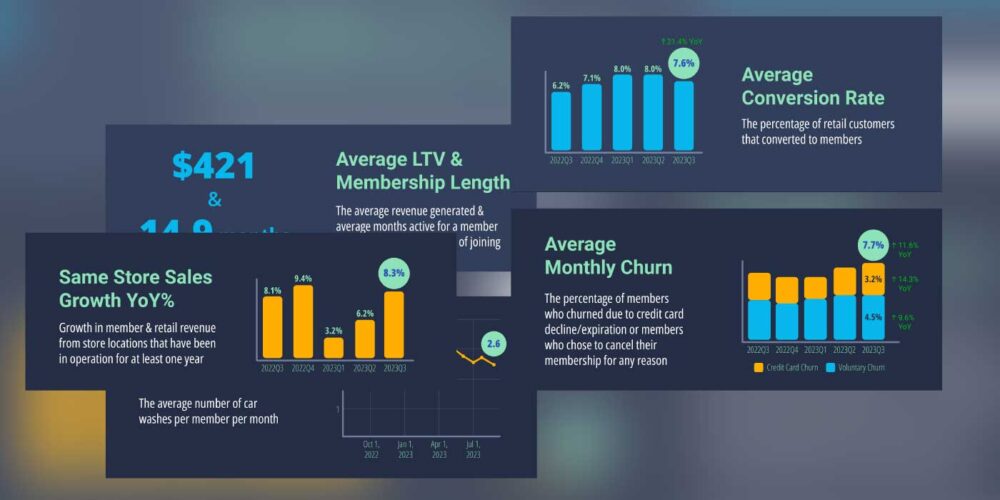

“An effective pricing strategy requires looking at the full picture — not just price but quantity sold and the percentage of total sale. That’s much more complicated, and that’s why most people don’t do it. But applying the proper shifts can increase volume, profitability, enrollment and even decrease churn,” advises Moriarity.

This paradigm shift puts a heavy focus on providing a great experience and value to customers. While membership and unlimited programs are driving traffic to your site, beating competition isn’t just about washing more vehicles. In addition to keeping pace with industry trends, consumer buying habits are also changing, and operators meeting these needs will have the competitive edge.

Martin concludes, “Overall, the industry is headed in a great direction, and operators still have a bright future ahead. But, with all these changes and growth, it leads one to think, ‘What’s next?’”