M&A activity in the carwash space saw a mild slowdown during the tail end of 2022 compared to the three years prior. Mid- to large-scale transactions saw the brunt of the reduction, while ground-up construction of new sites continued to be announced and accumulate at record levels.

Despite the all-time high levels of new carwashes being built, and no sign nor belief that such construction activity will slow down anytime soon, the recent slowdown in M&A activity is not here to stay and is best viewed as a temporary hiatus on the grander scale of the current consolidation cycle the industry is experiencing. M&A transaction activity will continue to persist in the years to come regardless of any short- or medium-term macroeconomic instability. This is the only way for the significant herd of mid-sized private equity-backed companies to see liquidity. And, although new builds are certainly filling the shoes necessary for achieving growth requirements, acquisitions will return as the preferred (and necessary) method in short order. The second half of 2023 looks as though it will reverse the momentary slowdown.

With the carwash industry having more sizeable players than ever before, along with it still experiencing persistent acquisitive activity to a level unseen prior to recent years, keeping track of all these transactions and buyers has become a chore and an onerous task. Beyond just keeping it all straight, the seeming luxury of being able to digest and visualize meaningful insights trends and magnitude of all these transactions has been but a pipedream … until now.

A new, and largely community-driven effort, has resulted in the creation and launching of the carwash industry’s first true repository and database of historical M&A activities. Car Wash Advisory has launched its first live version of an M&A database and has big plans for the future that lies ahead.

Idea inception

No industry, no group of people and certainly no community benefits from opaqueness and a lack of information sharing. When left in the dark, one is forced to assume the worst. When objective facts and truth is not offered to everyone in the common public, the game of perpetual broken telephone that can result is damaging and can spread misinformation.

The carwash industry has seen so many impressive companies go from simple, small operations to absolute juggernauts and titans; so many of which brought with them the gift to all of increased transparency into their sub-focus of the industry. All of which benefited the industry across the board to an immeasurable extent, which we often forget about and take for granted.

For instance, how about Sonny’s on the equipment (and many more) side of things? Try to imagine this industry today had Sonny’s not done so much and gone out on such a limb time after time to produce valuable information, insights and knowledge; and to then share it with the world, whether through YouTube videos or the creation of formalized industry-specific educational programs. Never before has the answer to the question of how much it costs to build a wash been so readily, accurately, and thoroughly covered and available to the public.

Take TalkCarWash on the social media community front, as another example. Tyler Slaughter and team have taken what was just a simple and small-scale community information sharing initiative and turned it into an irreplaceable mainstay and resource of the industry, currently with over 20,000 active

members. Never before has the community-driven answers to nearly any question or issue an operator has ever run into been so easily searchable and findable.

Whether it be the transaction side or the financial sponsor and acquisition side, this data has still remained bespoke, disparate and difficult to find. Trying to understand what chain, backed by what private equity sponsor, bought what group of washes and when the transaction occurred has remained an inconsistent and difficult labor and chore.

Car Wash Advisory has recently launched and will be continually, consistently and frequently updating and adding to what the company views to be the solution to this still lacking subsect of the industry. The Car Wash M&A Repository dataset, which is available to the entirety of the public alike, will be the gold standard of transaction-based data and details of the industry.

Car Wash Advisory, as notes its CEO, Harry Caruso, “hopes this will be an industry resource and mainstay to last decades to come.” With big plans on the horizon, the tool and data, now live, can be used even today.

Use cases

This resource can be used for many different applications and use cases already in its current state.

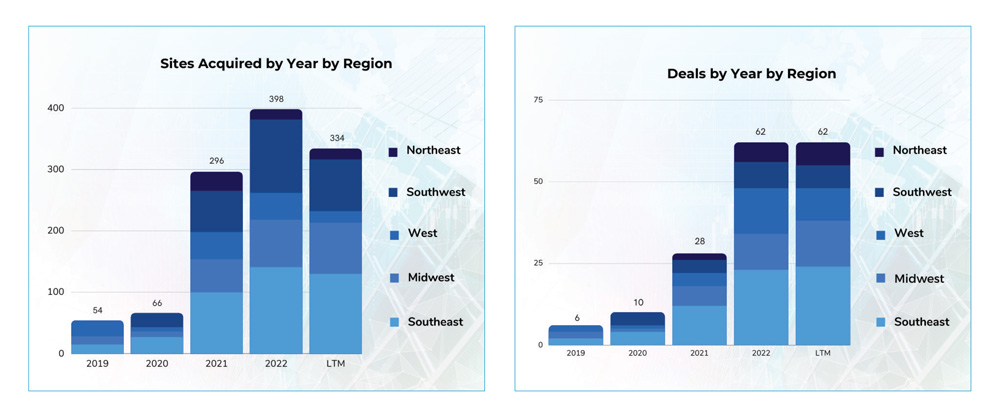

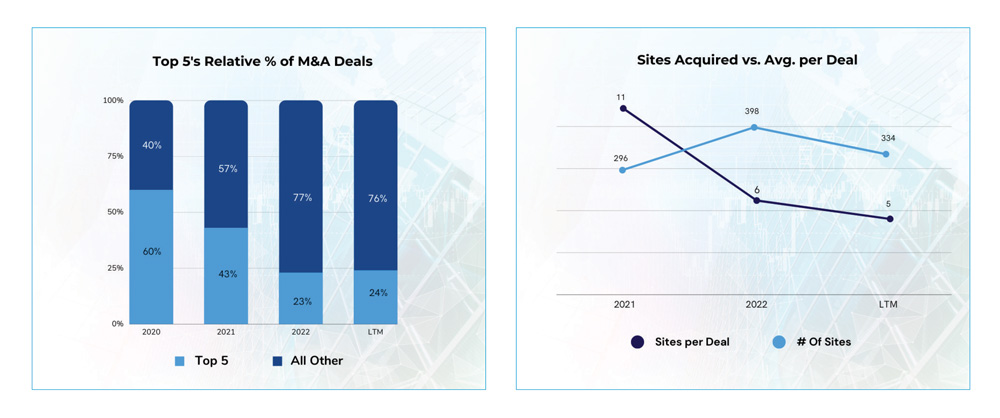

Interested in whether or not there has been a meaningful shift in geographical region focus by consolidators in the space? Is Florida and the Southeast getting disproportionate deal flow? This question, in the most basic sense, can be easily answered with the initial dataset by simply comparing by region transaction and transacted count volumes by region.

How about the popular question referring to where we are in the consolidation cycle in the carwash industry, “What inning are we in?” This data can be used to visualize and quantify an educated answer and view. Use such to map average site count per transaction (i.e. transaction size) versus quantity of transactions (i.e. transaction volume) to project when in time under either current trajectory or altering future projections, the carwash industry will reach the same levels of relative consolidation of more mature and consolidated industries, such as self-storage or auto collision centers.

And, how about what relative percent of industry M&A activity by site count is being performed by the top 5 companies each year?

Future plans and features

Community feedback will ultimately steer and drive the long-term direction and depth of this interactive dataset over time. “Please do bring attention to any suggestions, desires, errors or omissions,” says Colin May, managing director of Car Wash Advisory.

Some of the planned and most near-term incremental features to be added are already in the works — and, they are not small additions.

Time series data of site count

One feature on the 2023 rollout plan is site count time series data for the Top 100 Car Wash companies. The introduction of this incremental data will not only allow for meaningful overlays to be created, and tertiary derivations even from there, but will innately create a very meaningful dataset from the black space created — new builds by company by characteristic build figures, all dissectible and analyzable as a time series dataset.

Pipeline versus operating site distinguishment

On the data integration side, rather than analysis side, there is an equal amount planned. More and more acquisitions in the industry include a significant pipeline of to-be-developed or in-development sites (in addition to currently operating sites). “Pipeline” is arguably the most talked buzzword of the carwash transaction space of the last year, and most certainly the past six months. Although the current data available on launch does not distinguish pipeline (i.e. non-operational sites) versus currently operating sites, this feature and data will be available in the near future on an incremental release.

This level of visibility can at first be quite frankly startling. Upon sitting with such, one’s view tends to change. It’s important to recognize that anything and everything provided within the database is publicly available and offered on the internet, albeit across numerous disjointed sources and mediums until now.

The truth is that any person or group that really wanted to garnish such data and insights would have or already invested the resources necessary to internally produce and manufacture such. The only difference is that now, it’s available to everyone with an increased level of comprehensiveness, including non-static and frequently updated, and being easily and infinitely analyzable. All the puzzle pieces have always been out there. The only difference is that now everyone in the carwash community will be able to be confidently on the same page.

The goal of all this is to illuminate parts of the industry that are still in the dark. So many great companies have pushed this industry into new and unchartered territories, benefiting the entire industry as a whole. Car Wash Advisory intends to be one of those, and specifically become such through its investment into providing a new level of readily available and meaningful data in their subsect of the industry — M&A transactions within the carwash industry.

Car Wash Advisory is an M&A advisory firm that focuses exclusively on carwashes. At our core, we’re a carwash investment bank. We sell carwashes for owners. The carwash industry is brimming with more innovation than ever before. So much passion, collaboration and teamwork is being brought to the operating side of the business on a daily basis. We stand for bringing all the same — but to the transactional side of the carwash industry. For more information, please visit www.carwashadvisory.com.