Most business owners do not give their financial statements the attention they deserve. For carwash owners and operators contemplating the sale of their businesses, construction of a new location or investing in equipment, understanding the intricacies of financial statements becomes paramount to closing a deal. Financial statements need to be kept current as they provide a picture of your business financial health and growth potential at a specific point in time.

Financial mosaic: piecing together your business narrative

At the heart of financial reporting are three key statements: the balance sheet; income statement; and cash flow statement. Utilize a low-cost reporting option, such as QuickBooks, to house your financial data and consider other reporting options as your business grows and you are looking for more analytics.

The Balance Sheet provides a snapshot of your carwash financial position at a specific point in time. It outlines your assets, liabilities and owner equity. For potential buyers or lenders, the balance sheet is akin to an X-ray, revealing the skeleton of your business’ financial structure and value of its assets and debts.

For a carwash, this includes physical assets such as equipment and property, as well as intangible assets like customer goodwill, deposits and gift cards. Clear documentation of these items gives buyers a comprehensive view of what they are acquiring or investing in.

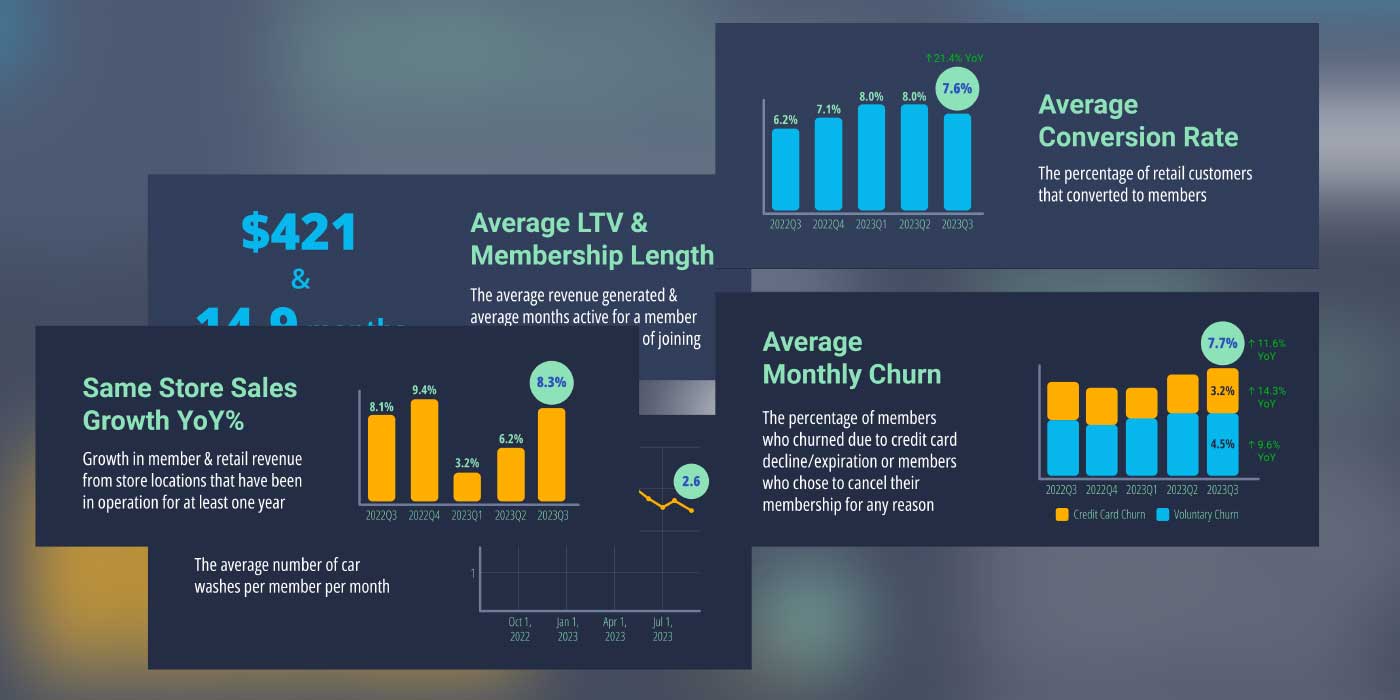

An Income Statement (also known as the profit-and-loss statement) details the revenue, expenses and profitability of the business. The more detail you can provide, the better. Instead of calling it sales, breakout your revenue to capture the various revenue streams, such as membership sales, carwash sales by package level, vacuum sales and vending sales. This level of detail will require additional time each month to gather but think about how powerful that level of data would be for you, let alone an outsider looking into the business.

Buyers and lenders are keen on assessing the historical financial performance of your carwash, so detailed income statements allow them to gauge revenue trends, expense patterns and profit margins over the years. A consistent upward trajectory is a powerful selling point.

The Cash Flow Statement tracks the cash moving in and out of your business. It ensures that your carwash venture has the liquidity needed to navigate day-to-day operations and strategic investments. Often overlooked, it’s a powerful gauge of whether or not the business can pay its bills and is crucial when acquiring another wash location as it allows you to see how every dollar is allocated and spent.

Transparency builds trust: an owner’s best asset

Imagine you are a potential buyer eyeing a carwash business. What would be your first point of interest? The answer invariably leads to its revenue and expenses. Financial statements act as a window through which potential buyers scrutinize a business.

Accurate and well-prepared financial statements instill confidence in prospective buyers, and often the more detail they include, the more value a savvy operator will place on your business. Today, there are dozens of tools and analytics that allow owners to provide data that investors and lenders want to see.

Imagine how valuable it would be for an operator to go into a purchase knowing how much business is done across wash packages or a specific type of service. Talk with your pay station manufacturer or membership management software provider to see what tools exist for you to start digging into the data already at your fingertips; you are likely already paying to have these services provided to you. This provides insight into your business and a way to parse out value.

Likewise, keeping your financials up-to-date allows you to detect inconsistencies and drive decisions.

While financial statements provide a roadmap of where your business has been, projections and forecasts offer a glimpse into its future potential. Presenting well-researched and realistic financial projections demonstrates your understanding of market dynamics and growth opportunities.

These projections should be grounded in a thorough analysis of industry trends, competitive landscapes and potential expansion avenues. If your membership data reveals strong retention and consistent month-over-month growth, you can make reliable projections. Honest acknowledgment of potential risks and challenges, backed by financial contingencies, showcases your business acumen.

Negotiating power: leveraging financial strengths

The strength of your financial statements is directly proportional to your negotiating power during the sale or underwriting of your carwash business. The goal should always be to make it easier for an outsider to decide on their next steps. A business with a history of stable financial performance is an attractive proposition and provides assurance to buyers and lenders that can be leveraged to negotiate favorable terms.

Well-prepared financials also drive the asking sale price or demonstrate the ability to payback a loan, both potent negotiating tools for getting a deal done. Buyers and lenders engage in thorough due diligence before finalizing a deal, and comprehensive and accurate financial statements streamline this process, reducing hurdles and expediting negotiations. Have your loan accountant statements available and be prepared to provide a valuation of business assets, if needed.

As you embark on the journey of selling your carwash business, consider the following steps to maximize the impact of your financial statements:

Engage professional assistance: Collaborate with financial experts, accountants and business valuation professionals to ensure that your financial statements meet industry standards and accurately represent your business’ financial health. The product should be a package of documents that provides potential buyers or lenders the information they need to decide, but also insight into ways for your business to grow.

Regular updates: Keep your financial records up-to-date, even if a sale or loan isn’t on the immediate horizon. This not only ensures accuracy, but also facilitates a smoother transition when you decide to sell or expand. It takes more time to recreate multiple months or even years than it does to regularly update your information. When looking at your financial statements, include a side-by-side comparison to the previous month of the year to highlight trends in the business.

Highlighting growth prospects: In addition to historical performance, emphasize the growth prospects of your carwash business. Showcase how strategic investments or operational improvements can elevate the future profitability of the venture.

In the intricate dance of selling or expanding a professional carwash business, financial statements emerge as the guiding compass. They narrate the past, elucidate the present and sketch the future of your venture. By meticulously preparing and presenting these financial documents, you not only attract potential buyers and receive stronger lending terms, but also pave the way for a smoother negotiation process.

When preparing for a sale or expansion, start the process of tightening up your financials as early as possible — ideally at least 18 months in advance. Remember, in the world of business sales, transparency is your greatest ally. As you unfold the financial canvas of your carwash business, you’re not just selling a business … you’re selling a vision, a legacy and a promise of future prosperity.

Alex Smith is a Certified Public Accountant (CPA) who specializes in accounting and tax strategy for carwash owners and auto detailers throughout the United States. As a self-serve and IBA carwash owner, Alex understands the unique aspects of the industry and knows the ways to save owners thousands on their taxes each year and can help position them to strategically grow their businesses. The Carwash CPA is a brand of Patapsco Corporate Services, a registered accounting firm in the state of Maryland.