Is it even worth getting involved as a first time owner, given all the “big” money coming in? Doesn’t private equity already own the whole industry? Who are these people calling me every day asking me if I will sell my wash?

These are questions I get asked all the time when speaking to current and prospective wash owners.

Private equity’s presence in the market is an important topic for the entire sector, regardless of your size and status in the industry. New money from these institutional investors impacts everyone.

Consolidation is occurring and has been for several years. Private equity is in the space — and already is a substantial player. There is no doubting this, and it’s understood. What is not nearly as clear is the extent to which private equity is involved in the industry.

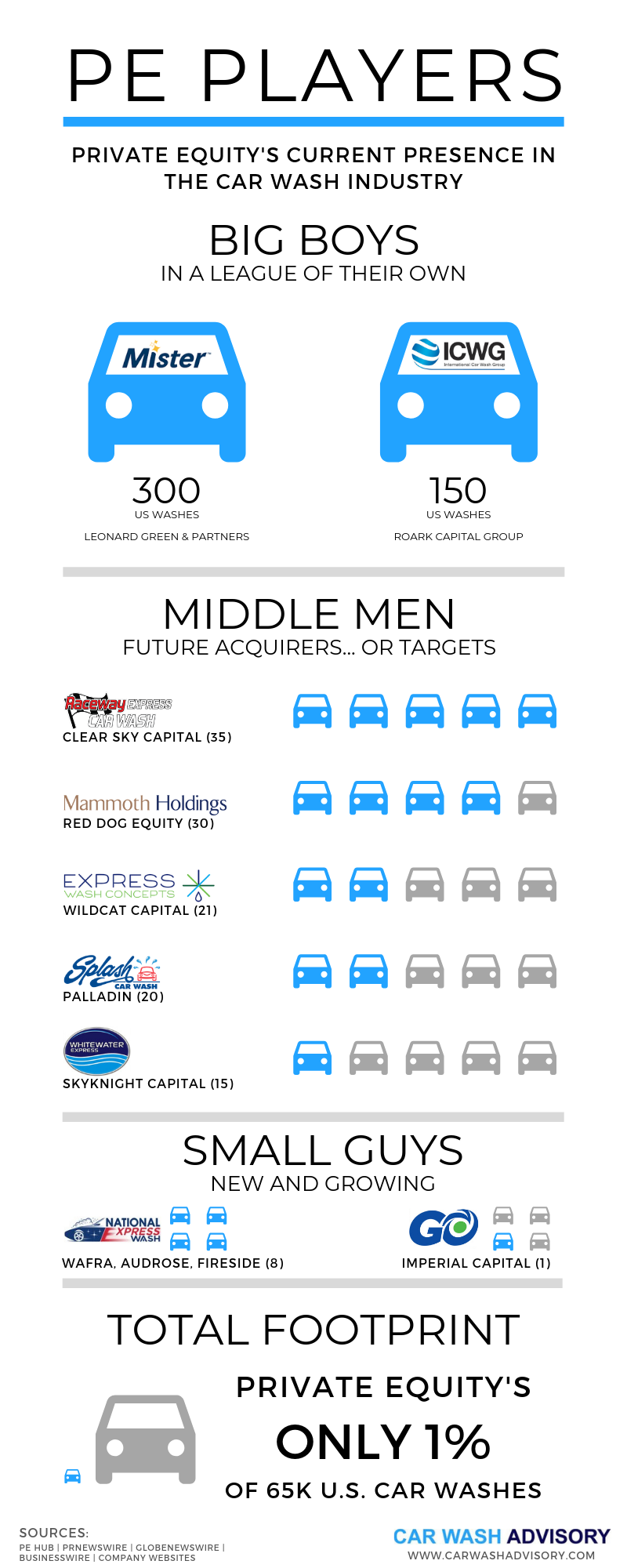

Below you will find an infographic that provides a simplified illumination of tangible numbers and magnitudes.

The answer is that private-equity-backed carwashes only account for a low, single-digit percentage of the carwash population in the U.S. This is true whether you want to count all carwashes (as the infographic does) or if you only want to count conveyor washes (which roughly doubles the market share). Wall Street and investment funds are coming into the arena at a rapidly increasing rate. The ripple effects this will continue to have, along with the projected growth trajectory and market share capture, are an entire story on its own. But for now, know that as of today, institutional private equity is still a small player in the carwash space.

Be on the lookout for the rest of Caruso’s article in the November 2019 issue of Professional Carwashing & Detailing.

Harry Caruso is the founder and CEO of Car Wash Advisory, a leading carwash brokerage. Harry has a background in investment banking, capital raising and investing. He started in the auto sector over a decade ago building engines and race cars. Connect with Harry at www.carwashadvisory.com.

Check out a recent follow up video interview with the author, Harry Caruso, in the below video.