Would you believe that the Top 50 list is viewed on our website, Carwash.com, every single day? Then again, this might not come as a surprise. Many chains on the list command news headlines throughout the year, announcing acquisitions, construction, etc. These headlines pull our attention into a microcosm of the industry, and as we watch these chains grow, we may get the feeling that the competitive market is shrinking. But is it really?

The professional carwashing industry has historically been considered highly fragmented, and that statement still holds true today. According to Paul Fazio, CEO of SONNY’S The CarWash Factory, it has been 20 years since the push to consolidate the industry began, and yet the amount of locations owned by those in the Top 50 is still just a drop in the bucket compared to the market as a whole.

George Odden, principal, Commercial Plus, agrees. “The consolidation of this industry is truly in its infancy. It feels like there’s been a lot of activity, and there has been compared to history, but nothing compared to the amount of activity that there could be,” he notes.

Statistics from the International Carwash Association (ICA) cite approximately 28,500 conveyor/tunnel carwashes in North America. The number of Top 50 tunnel locations, which according to our list currently equals 1,574, is therefore only about 5.5 percent of the total number of tunnel locations on the continent.

“Today, based on the Top 50 list, there are only three companies that own more than 100 locations, five that own more than 50 locations and 10 that own more than 30 locations,” explains Fazio. “Those numbers tell you that yes, this industry is still extremely fragmented. Who would believe you only need 10 locations to make the top 50 largest companies in the industry? And in that Top 50 list, I still see families that I have known now for at least three generations.”

The family-owned-and-operated nature of the industry is precisely the reason for this fragmentation, industry experts say. While there’s a trend moving toward larger operations, it has taken and will continue to take time to grow.

Considering that exactly half of the chains on the list have 20 or more locations, which is still fairly small, Steve Gaudreau, president of Brink Results LLC, remarks, “That’s a very fragmented industry compared to any other industry. Matter of fact, I don’t know any other industry this fragmented.”

So, are we paying too much attention to this corner of the market? Actually, while the Top 50 list is indeed only a snapshot of the industry, an analysis of the list reveals several trends that align with it as a whole.

Delving into the Top 10

Last year, we marked a significant change in our Top 50 list.

From 2014 to 2016, the same carwash chains dominated the top five slots in the same order: Mister Car Wash, Autobell Car Wash, Wash Depot Holdings, Goo-Goo Express Wash and Boomerang Carwash. However, Zips Car Wash acquired Boomerang in August 2016, and International Car Wash Group (ICWG) acquired Goo-Goo in August 2017, putting ICWG in second place and Zips in third place last year.

This year, there are another two significant changes to the list. But, let’s just start from the top.

It’s no surprise that Mister Car Wash takes first place this year once again. With 264 locations, it has a whopping 124 locations over the runner-up. What is interesting to note, however, is that between 2016 and 2017, Mister jumped from 178 locations to 250 — a remarkable 72-location leap. This year, however, Mister’s growth has noticeably slowed down, with only a 14-location gain over last year.

In 2017, Zips placed third with 94 locations. This year, the chain had an impressive 46-location gain, largely due to acquisitions, which bumped it into second place. While this jump is not quite as high as its 71-location jump the previous year, consider that 31 of the locations on the 2017 list came from the Boomerang acquisition alone.

ICWG had a modest eight-location gain this year, and Autobell increased by three, following the steady pattern in which it has added three to six locations yearly since 2014.

The other significant change to this year’s list involves fifth place. In another notable jump from 40 locations in 2017 to 74 locations in 2018, Quick Quack Car Wash has now moved up from sixth to fifth place. In fact, Quick Quack’s growth this year surpassed its previous year’s growth. On our 2016 list, Quick Quack had 29 locations, meaning it grew by 11 locations last year and 34 this year. Even more remarkable is that 21 of these 34 locations were new-builds, according to the company. Gaudreau states, “As far as I know, nobody has had that many new-builds in one year in carwash history. The level of planning and infrastructure development to pull this off is astounding.”

With the exception of one newcomer, the rest of the names in the Top 10 are familiar, but their rankings have shifted around a little bit. As mentioned in the previous article, several carwashes that have appeared on our list in the past are now reappearing on this year’s list but under new names and organizations.

For instance, in seventh place is True Blue Car Wash, which is an umbrella organization encompassing several regional names. Three of these — Clean Freak Car Wash, Personal Touch Car Wash and Rainstorm Car Wash — have been on our Top 50 list in past years.

Looking at the numbers, it appears the growth trend has slowed. For instance, last year, we reported a 32 percent increase in the number of Top 10 locations alone. This year, there is only a 17.4 percent increase (758 to 890). Granted, this number reflects the addition of True Blue. However, even if we strictly compare the carwashes who appeared in the Top 10 on both the 2017 and 2018 lists, (729 locations to 842), that is still only a 15.5 percent increase.

In response to these percentages, Odden remarks, “I think that’s probably more indicative of a few large transactions that happened earlier. I feel like there is still a very steady amount of mergers and acquisitions (M&A) activity. I think some of the larger players are still opportunistically making large acquisitions but perhaps are also focusing on digesting the acquisitions that they’ve made and working towards improving operations and developing new sites.”

A shortage of sellers

In recent years, we’ve reported on numerous acquisitions. As evidenced by the growth of the Top 50 list, even if the trend has slowed, it’s still significant. Why? Everyone wants to grow, industry experts say — it’s all in a matter of how they get there.

“The larger groups are interested in acquisitions because they can get those deals done quicker,” explains David Begin, managing partner of Wild Blue Car Wash, 2017 president of ICA and host of The How of Carwashing podcast. “It’s much more difficult to build carwashes today than it was 10 years ago, and it takes a lot more time. The private equity firms are interested in getting capital deployed. The mid- and lower-levels are willing to take the time to build, but that return on investment will take months and years.”

It’s no secret that acquiring a carwash is a more appealing option for those looking to grow — as long as the price is right and the opportunity is there.

That said, Begin notes that there are two phases that private equity firms look at when expanding. The first phase is acquiring. According to Begin, it’s gotten to the point where these firms are being pickier about the washes they want to buy, and at the same time, there are fewer operators out there now willing to sell. With acquisitions no longer being as viable an option, private equity firms are moving into phase two, which is the building phase. Since building takes so much longer than acquiring, it’s no wonder the trends are slowing down.

“I don’t believe we have seen a peak,” Fazio notes about the trend. “However, as asking prices climb, then building becomes the way to expand — especially in areas where you already have a presence. I really believe it’s a slowdown based on pure economics, not a lowered desire to grow.”

Gaudreau agrees. “Just about every chain in the country has been called on by multiple investors. This is a very hard industry to consolidate,” he adds, noting that many of the chains that remain are family-owned and are not interested in selling.

However, he says, while acquisitions may have slowed down due to lack of supply, the new-build market is still on fire. “From a new ground-up situation, [the market’s] as hot as it’s ever been. It hasn’t slowed down one iota. And everybody, both large investors and small investors, would go faster if they could.”

Regional hotspots

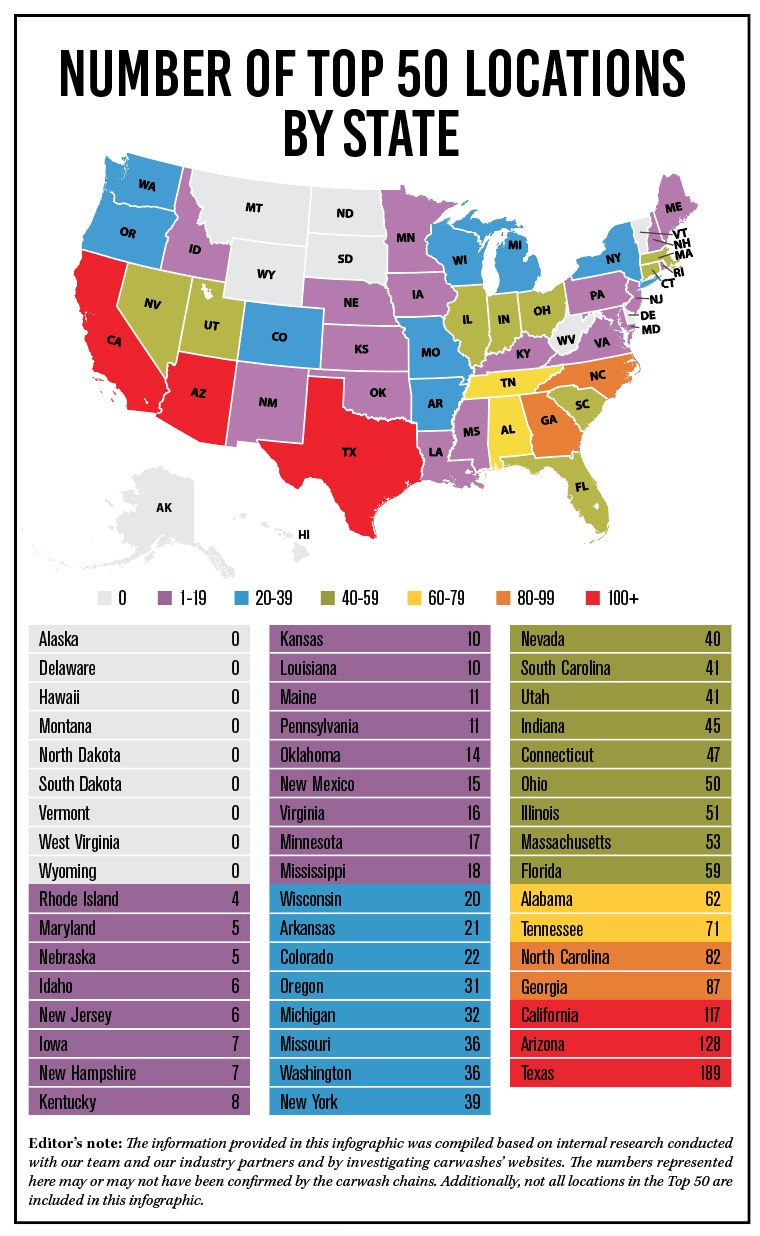

On Carwash.com last year, we published an interactive Top 50 Map showing the locations of the headquarters for the Top 50 conveyor carwash chains across the country. Just by headquarters alone, the dominance of chains in California, Arizona and Texas was substantial. But, how about we take it one step further?

Have you ever wondered where the greatest concentration of Top 50 locations are? Somewhat unsurprisingly, at 189, there are more Top 50 locations in Texas than any other state. Arizona comes out second at 128, and California rounds out third with 117. These three states are the only ones in the country with over 100 Top 50 locations within their borders. However, looking at it in perspective, this isn’t really surprising.

According to the experts we interviewed, the Southeast, Texas and the Southwest (particularly Southern California and Arizona) have historically been hotspots. Southern California is a relatively new hotspot as of the last couple years, but it’s also a challenging market because of the associated costs and the trend of leasing versus owning property there.

The numbers, however, make sense. California and Texas are the two most populous states, while Arizona is 14th.1 California and Texas are also the two largest states in the contiguous U.S. As such, these states can support the numbers both in terms of population density and land area, compared to the smaller states (area-wise) of the Northeast, for instance. Something else to note about these areas is the climate. Arizona, Texas and parts of California are arid and dusty — perfect conditions for needing a car washed year-round. So, not only are the demographics sustainable, but the demand is also there.

According to Odden, while the Southwest in particular appears to be approaching saturation and he believes there will come a point where only the better operators survive, currently the major players there are still growing, and there’s room for new entrants in the space.

To that end, Fazio warns, “Yes, the industry is very healthy, and all the data I have looked at is very positive for years to come. … The only thing I see that could create a real issue is overbuilding in a market. We see so much opportunity in areas that are underserved that we just can’t understand why someone would build on top of an existing site. Are there areas where the density makes it possible to have locations close to each other? Of course there are. But success in this business is still very much tied to location and competition. So to me, the health of our industry going forward is very much in our own hands.”

That being said, there are also several states where there is no Top 50 presence: Alaska, Delaware, Hawaii, Montana, Nebraska, North Dakota, South Dakota, Vermont, West Virginia and Wyoming. Unsurprisingly, of the 15 least populous states, these make up all but four of them.1 In fact, the other four least populous states include New Mexico, Idaho, New Hampshire and Maine, all of which have 15 or fewer Top 50 locations.

From this, it’s clear to see that the larger market players are definitely concentrating on populous areas of the country. However, it’s not just about population but about growth potential too.

“You cannot compare the amount of raw dirt development opportunities [in the Northeast] versus somewhere like Texas,” Fazio notes. “So, the speed at which you see projects happen is much slower in somewhere like greater Boston than greater Dallas. But, I think the desire for growth is nationwide.”

As such, it’s easy to see why the Southeast as a whole averages in the mid- to high-end of the spectrum of Top 50 locations, according to our map. The Northeast, on the other hand, which has a dense population but less available area, averages on the lower end. Remember, though, that these numbers only reflect the tunnel segment. While the northern U.S. does not have a huge tunnel presence compared to other regions, other segments of the industry are growing across the country as well.

“There’s still a lot more money out there that wants to be deployed than is able to be deployed,” Begin states.

In fact, Odden sees the development of markets in two waves. In the first wave, the industry concentrated on developing the major metropolises. Now, however, Odden sees interest in smaller cities. “I think the next big wave is people acquiring and building chains that serve the second- and third-tier cities,” he proclaims.

What’s in a name?

While this map may show you the presence of the combined total of Top 50 washes, what it doesn’t reveal is a regional breakdown by carwash. If you were to research the individual washes, you would note that there are only a handful with a “national” presence. Mister Car Wash by far has the largest presence in the country with footprints in 21 states. While it does indeed reach from coast to coast, because it does not have a presence in over half of the country, the descriptor of “national” is debatable. Nevertheless, it is the closest to being a nationwide chain.

ICWG is the next “national” player, with a presence in 11 states ranging across the country, according to our internal, non-verified research; however, it takes a different approach. While Mister’s locations are all branded under one name, ICWG retains the names of each regional brand under its umbrella (a marked contrast to its solid IMO branding across Europe and Asia-Pacific).

Compare this to Zips, which has a 13-state presence but remains congregated primarily in the Southeast. In fact, whether the chains fall under one name or many names in an umbrella organization, most chains tend to stick to one region, and depending on the size of that chain, often just one state.

“A carwash by its nature is local,” Odden states. “The value of a national brand is probably lower in this industry than in many, and the value of a strong local brand can be huge.” However, he notes, there is certainly a case for changing the branding of an acquired carwash. Odden believes that if the acquired carwash is not up to the standard of the acquirer, there is value in rebranding it while raising the standards both physically and operationally.

Of course, rebranding is easier said than done. “It’s a lot of effort to come up with a national brand,” Begin explains. “It’s easier to be regional. If you’re not getting the network effect, then keeping the original brand could be effective [when acquiring a carwash].”

Begin goes on to explain how, for carwashes that choose to acquire and rebrand, there are several associated costs, including: changing signage, creating the same tunnel experience and making the carwash’s look and feel as consistent as possible for the customer in terms of coloring and experience, since the building of an acquired carwash may differ vastly from what a brand already has.

Gaudreau agrees but indicates that whether to have one or multiple brands depends on how big you want to become. “If you’re looking to become a national brand, one brand adds value to what you’re doing.” However, he says, there is a case to be made for those who acquire three or four regional brands but are not interested in going national. Keeping the regional brand identities means spending less, since the previous owners already invested in making those brands known.

“This is why to date franchising in our industry, even by well-known, nationally recognized names, has not been received well,” Fazio elucidates. “In fact, most [carwashes don’t] even have a regional presence as big as these family companies you see on the list today. So, the value available in the franchise is limited to operations help. That being the case, after a year, the franchisee is left questioning the value of the ongoing royalties.”

A glimpse of the future

All of the experts we interviewed had the same reaction to the Top 50 list: astonishment that most of the list is still dominated by family-owned companies, as opposed to private equity firms. In fact, Fazio finds it funny to hear how many next-generation young adults, who swore they would never go into the carwashing industry, are now joining the family businesses.

Even those new to the industry are flocking to it. Gaudreau notes that he has had numerous calls from new investors wanting to enroll in carwashing classes before they even have the brick and mortar in place. All in all, the industry is currently going strong, and the experts are bullish about the future.

“It depends obviously on what the economy does, what the effect of tariffs are going to be, because I’ve heard issues of people saying it’s getting difficult to buy steel, it’s difficult to buy some building materials and it’s getting more expensive to do those things,” Begin notes. “So, as long as the economy holds together, as long as interest rates stay relatively low … and there’s money out there looking for opportunities, then I think we’ll continue to see growth.”

As far as this list is concerned, while it took having “only” 10 conveyor/tunnel locations to make it onto the 2018 Top 50 list, it’s interesting to note that each year since 2014, the threshold from the list has increased by one. In 2014, for instance, the smaller companies had six carwashes; in 2015, it was seven, and so on. What this shows is that there are enough growing chains out there that are able to supplant an entire section of four or five carwashes to raise the list’s threshold — and this steady trend has continued year over year.

Will next year’s threshold be 11 locations? Only time will tell.

Source: