In the fiercely competitive carwash market, owners have made investments for a multitude of reasons, including consistent demand, recurring revenues and scalability. However, many commercial owners encounter various challenges when it comes to optimizing cash flow and minimizing tax liabilities. As a carwash owner or operator, you understand the importance of maximizing profits while minimizing expenses. One often overlooked avenue for significant savings lies in optimizing your tax strategy.

In this article, we’ll explore the benefits of Cost Segregation and Bonus Depreciation — two powerful tools that can help save money and improve your bottom line. But, before diving into how these strategies can revolutionize your carwash business, let’s review how depreciation, usually classified as a loss in value, can be a tool for increasing tax savings.

Depreciation

When depreciation is brought up to discuss the devaluing of a vehicle or a home, it is seen as a negative; in other words, the item is losing value. However, the same is not true for commercial businesses.

Depreciation becomes a tool that can be used to offset profits made in the business and therefore, reduce overall tax liability. There are two methods for depreciating commercial properties. The first is Straight Line depreciation, where the standard method is dividing the purchase price of a building less land over 39 or 27.5 years, dependent upon commercial or residential use.

For example, if a building was purchased on January 1 with a cost basis (less land) of $1 million, the owner would be entitled to apply an annual accrual of $25,641 toward his or her tax liability each year until the end of the 39-year term or sale of the building. This is derived by simply dividing the cost-basis value of the property by the 39-year term that commercial assets are held.

Each year the tax benefit would accrue an additional $25,641 until the end of the 39-year lifecycle or if the building is sold. In the 39th year of ownership, the depreciation would reduce the tax liability by $370,000 (assuming a 37% tax rate).

Now imagine accelerating this process and receiving that same tax savings benefit in the first year rather than waiting the full 39-year term. How tremendous would that tax savings be to your bottom line, cash flow and even current tax year obligation? The increase in cash flow could pave the way for renovations, employees, property and portfolio expansion prior to the end of the property’s lifecycle. Furthermore, the time value of money states a dollar today is worth more than a dollar tomorrow.

Let’s dive deeper into how this tax savings strategy can be applied and why it is a great fit for carwash owners and operators.

The power of Cost Segregation

Cost Segregation is an IRS-approved tax savings strategy that can significantly benefit carwash owners. This tax strategy can be applied to most commercial buildings and even short-term rentals. However, not all commercial buildings provide the same tax savings across all property types.

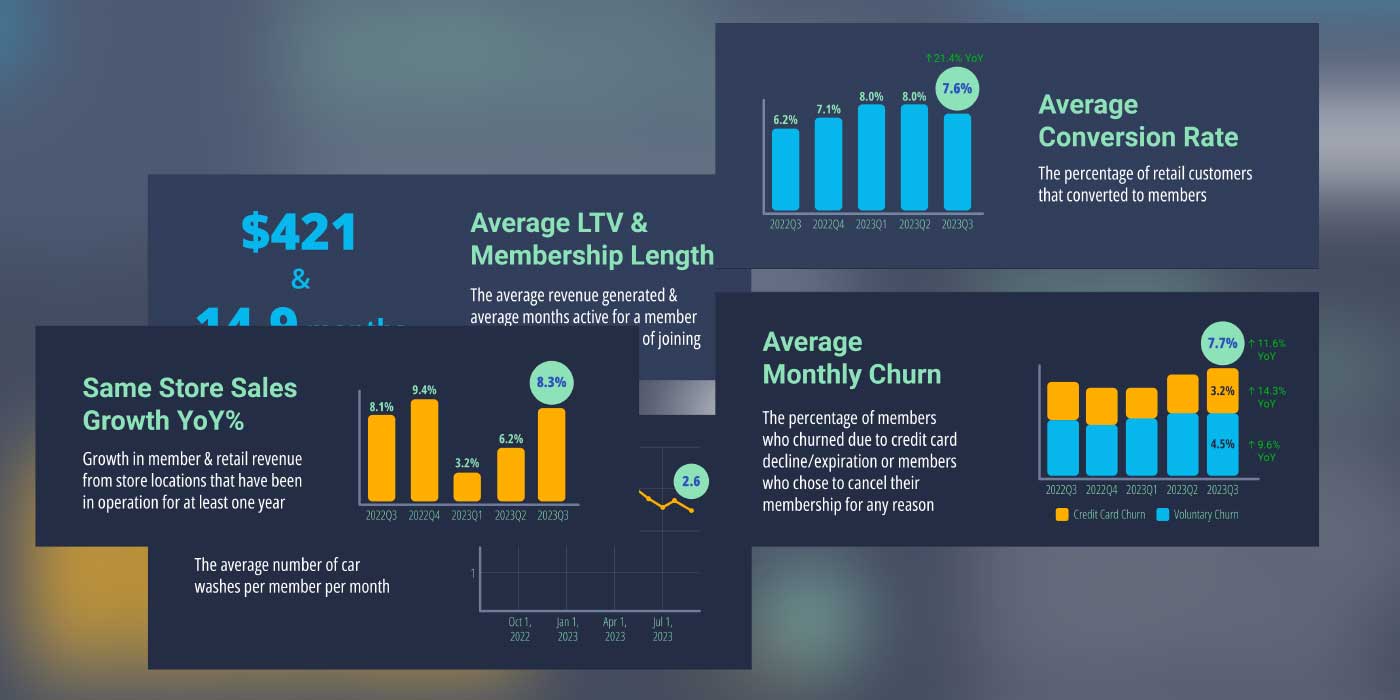

Some properties perform better than others in terms of how much of the building can be reclassified for accelerated depreciation. Luckily for carwashes, which typically have a mix of building structures, land improvements, specialized equipment and signage, Cost Segregation can significantly reclassify on average 65% to 100% of the building price to enhance cash flow and reduce taxable income.

That means on a $1 million carwash, between $650,000 to $1 million can be identified and reclassified for accelerated depreciation depending on the type of carwash (retail versus tunnel). When compared to other commercial building types, the average reclassification ranges between 20% to 40% that can be identified and accelerated. By understanding these concepts and leveraging their potential, carwash operators can utilize these tax savings to improve cash flow, reduce tax liabilities and fuel business growth.

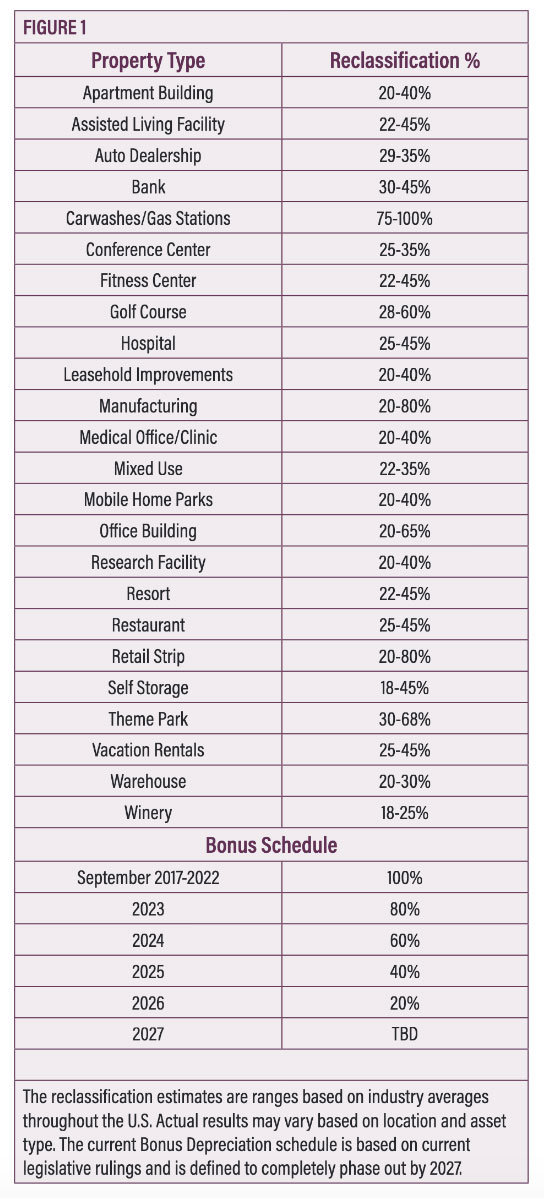

Figure 1 highlights the average reclassification percentage based on the property type. The greater the reclassification, the greater the overall tax savings.

Asset classification

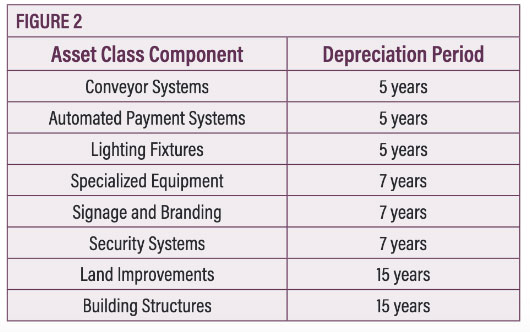

By working with qualified Cost Segregation professionals, professional carwash owners can identify as well as reclassify assets that are traditionally subject to longer depreciation schedules common in the Straight Line method. Cost Segregation involves reclassifying assets into their specific 5-7-15-year asset class categories.

For instance, Figure 2 outlines the type of assets in the carwash industry and their corresponding depreciation period.

Rather than depreciating the entire asset class components over 39 years, Cost Segregation breaks down each item into its respective depreciation period. This reclassification results in higher depreciation deductions in the early years, increasing cash flow and reducing tax liabilities.

Unique benefits of Cost Segregation in carwashing

Carwash businesses offer distinct opportunities for Cost Segregation due to the industry’s specific assets and operational requirements. Consider the following carwash-specific components that can be effectively segregated:

Carwash bays: Carwash bays, including flooring, walls, doors and drainage systems, can be classified as land improvements. By depreciating these assets over a shorter recovery period, carwash owners can enjoy immediate tax benefits, resulting in increased cash flow.

Specialized equipment: Carwashes rely on a range of specialized equipment, such as conveyor systems, water treatment systems, drying mechanisms and vacuum stations. Properly segregating these assets allows owners to accelerate depreciation, reduce taxable income and bolster cash flow in the crucial early years of operation.

Signage and branding: The carwash industry heavily relies on visual marketing, making signage and branding integral to the business. These assets can be classified separately and depreciated over a shorter time frame, generating additional tax savings.

Bonus depreciation and its impact

The Tax Cuts and Jobs Act of 2017 (TCJA) introduced Bonus Depreciation, which is an additional incentive to promote business investment. This provision allows for immediate 100% expensing of qualified property placed in service after Sept. 27, 2017, and before Jan. 1, 2023, to accelerate the 5-7-15-year assets within the first year.

Phase-out schedule

It’s important to note that the Tax Cuts and Jobs Act includes a phase-out schedule for bonus depreciation. Starting in 2023, the percentage of bonus depreciation decreased to 80% and will gradually reduce by 20% annually until it is completely phased out by 2027. Therefore, carwash owners should take advantage of the current favorable bonus depreciation rates while they are available.

The added advantage is that these benefits are retroactive. The building would still qualify for the bonus depreciation if the carwash was purchased in prior years during the TCJA era. Operators are grandfathered into the date the property was placed into service. The owner/operator would need to submit a form 3115, signifying a change in the depreciation schedule to the IRS. This does not trigger an audit nor requires amended tax returns.

Form 3115: Also known as the Application for Change, this is a document used by taxpayers to request a change in their accounting method for tax purposes.

Tax optimization: Changing the accounting method can sometimes result in tax savings or other financial benefits. For example, a taxpayer may want to switch to a method that accelerates the recognition of expenses, resulting in a lower taxable income. This scenario would require form 3115 to acknowledge to the IRS that Cost Segregation has been applied to the depreciation schedule. It is best to consult with a tax advisor to ensure all requirements are met.

Competitive advantage

Implementing tax-efficient strategies like Cost Segregation and Bonus Depreciation gives carwash businesses a competitive edge. Increased cash flow allows for better maintenance, improved customer experience and the ability to invest in new technologies or eco-friendly initiatives. This, in turn, enhances the overall customer perception and differentiates the business from competitors.

Increased cash flow: Cost Segregation and Bonus Depreciation allow carwash owners to generate higher depreciation deductions in the early years of operation. These increased deductions result in lower taxable income and can be reinvested in marketing efforts, equipment upgrades, staff training and expanding the business.

Accelerated ROI: With increased cash flow from tax savings, owners can recoup their initial investment faster, allowing for quicker reinvestment and business growth.

Carry forward: The after-tax savings can be carried forward indefinitely to future tax years if the full sum of savings has not been met.

Sale-leaseback transaction: Cost Segregation can be utilized in a sale-leaseback transaction within the carwash industry to potentially optimize tax benefits for both the seller (carwash owner) and the buyer (investor/lessor).

How Cost Segregation works in a sale-leaseback

In a sale-leaseback arrangement, the carwash owner sells the property to an investor or a third-party entity while simultaneously entering into a long-term lease agreement to continue operating the carwash business at the same location. The investor becomes the new owner of the property and receives rental income from the lease payments made by the carwash operator.

There are several benefits under this arrangement for the investor. By conducting a Cost Segregation study, the investor can potentially increase their depreciation deductions and reduce their taxable income from the rental income generated by the carwash property. This can result in higher after-tax cash flow for the investor during the lease term.

There are also several benefits for the carwash owner. The carwash owner, as the lessee, may negotiate a lower lease payment based on the increased tax benefits obtained by the investor through Cost Segregation. This can lead to improved cash flow for the carwash operator, as the lease payments may be more manageable or reduced compared to a traditional lease arrangement.

It’s important to note that the tax benefits and potential cash flow improvements from Cost Segregation in a sale-leaseback transaction depend on various factors, such as the property’s cost basis, its component breakdown, lease terms and individual tax situations. Carwash owners and investors should consult with tax professionals, including accountants and tax advisors experienced in Cost Segregation and sale-leaseback transactions. It’s crucial to comply with all tax regulations and ensure all requirements adhere to the IRS guidelines.

Understanding the limitations

Cost Segregation is a tax strategy that aims to accelerate depreciation deductions by reclassifying certain building components into shorter recovery periods. While Cost Segregation can provide significant tax benefits for many commercial property owners, carwash owners should be cognizant of the following limitations specific to their industry:

Non-income-generating or loss: The primary focus is to offset tax liability derived from income, but if the carwash is not generating revenue this will limit the potential tax benefits for carwash owners. Additionally, if the property has already incurred a loss or has expenses for the year to offset income, the additional depreciation may be less significant to lower the tax liability. In essence, the owner would be adding depreciation to their depreciation.

Short sale: Carwash owners who plan to sell their property shortly should consider the implications of a short sale. If a property subject to Cost Segregation is sold before its normal depreciable life ends, the accelerated depreciation deductions claimed through Cost Segregation may need to be recaptured. This means that a portion of the previously claimed tax benefits could be subject to additional taxation upon the sale of the property. It is important to evaluate the potential impact of a short sale on the overall tax strategy and consider the holding period of the property before pursuing Cost Segregation.

Recapture tax: Cost Segregation can provide upfront tax savings by accelerating depreciation deductions. However, it’s essential to understand that these deductions may be subject to recapture tax in certain circumstances. If the property is sold or disposed of at a gain in the future, the accelerated depreciation deductions claimed through Cost Segregation may trigger recapture tax. Recapture tax is the repayment of a portion of previously claimed tax benefits, and it is typically taxed at a higher rate than ordinary income. Carwash owners should evaluate the potential recapture tax implications and consult with a tax professional to understand the long-term tax consequences of Cost Segregation.

There are methods to defer capital gains and bypass the recapture tax, but this is advised to be performed by a 1031 qualified intermediary and tax professionals. Their expertise and guidance can help navigate the complexities of these transactions, mitigate recapture tax risks, and ensure compliance with applicable tax laws.

Conclusion

In the carwash industry, where cash flow and tax savings play a crucial role in business success, Cost Segregation and Bonus Depreciation emerge as powerful tools. By partnering with qualified professionals, carwash owners and operators can optimize their tax strategies, accelerate depreciation deductions and unlock substantial cash flow benefits.

Leveraging the unique assets and components of the carwash industry, Cost Segregation ensures accurate asset classification, compliance with IRS guidelines and enhanced tax savings. Similarly, Bonus Depreciation provides immediate expensing of qualified property, resulting in increased cash flow and accelerated ROI within the first year. By harnessing these strategies, carwash businesses can pave the way for financial growth, competitive advantage and long-term success in a demanding industry.

Sean Lichterman is a Cost Segregation consultant for Cost Segregation Services Inc. (CSSI). He can be reached at [email protected] or 224-814-3174. Sean and CSSI provide IRS-approved Cost Segregation studies to over 30,000-plus commercial property owners. Maximize your tax benefits, one property at a time.